|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Understanding the California Credit Report Check Process

Introduction to Credit Report Checks

In California, a credit report check is an essential part of financial health management. Whether you're applying for a loan, renting an apartment, or just keeping tabs on your financial standing, understanding your credit report is crucial.

How to Obtain Your Credit Report

There are several ways to obtain your credit report. In California, consumers have the right to access their credit reports for free once every 12 months. You can request all 3 credit reports from the major credit bureaus: Experian, TransUnion, and Equifax.

Online Requests

- Visit the official websites of the credit bureaus.

- Fill out the necessary forms and verify your identity.

- Download your report securely.

Mail Requests

Alternatively, you can request your reports by mail by sending a written request to each bureau. This method might take longer but is equally effective.

Why Regular Checks Matter

Regular credit checks can help you detect errors and fraud early. By keeping a close watch on your credit report, you can identify inaccuracies that may affect your credit score.

Improving Your Credit Score

Consistently checking your report can highlight areas for improvement. You can focus on paying down debts or ensuring timely payments.

Preventing Identity Theft

Monitoring your credit report can alert you to potential identity theft. Quick action can prevent long-term damage to your credit profile.

Common Errors in Credit Reports

Errors in your credit report can significantly impact your credit score. Here are some common issues:

- Incorrect personal information

- Accounts that do not belong to you

- Incorrect account status

- Duplicate entries

If you spot any errors, it's important to dispute them immediately with the credit bureau.

Resources for Further Assistance

Several resources can assist you with managing and understanding your credit report. The personal credit file guide offers detailed insights and tips.

Frequently Asked Questions

What is a credit report?

A credit report is a detailed record of your credit history, including your borrowing and repayment activities, compiled by credit bureaus.

How can I dispute an error on my credit report?

To dispute an error, contact the credit bureau that issued the report. Provide documentation supporting your claim and request a correction.

How often should I check my credit report?

It's recommended to check your credit report at least once a year to ensure accuracy and monitor for potential fraud.

California employers may not use credit reports in making employment decisions, unless an exception applies.

A California law signed into effect by California Gov. Jerry Brown in 2011 prevents most employers from using credit scores and credit histories ...

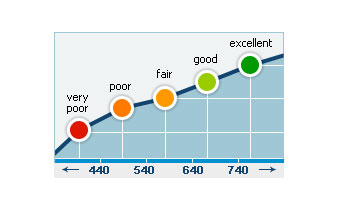

However, individuals with scores of 700 or higher are generally eligible for the most favorable terms from lenders, while those with scores below 700 may have ...

![]()